QuanLoop Review: Is Kwanloop Legit?

As u al ooit gewonder het of QuanLoop wettig is, dan het u op die regte plek gekom. Hierdie groothandelsfirma is nie 'n bedrogspul nie en bied diversifikasie deur risikofaktore en 24-uur-likiditeit aan beleggers. Dit bied 'n EUR1-aanmeldbonus en stel beleggers in staat om in EUR1, EUR2 of EUR5 per risikoplan te belê. Hierdie beleggingsplatform elimineer die risiko's verbonde aan wanbetalers en bied 'n eenvoudige manier om met risikofaktor te diversifiseer.

Quanlop is 'n groothandelfirma.

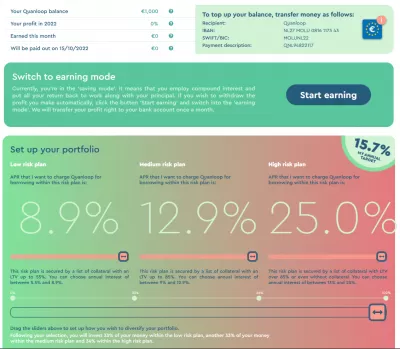

QuanLoop is 'n groothandelsbeleggingsondernemingwat sy kliënte in staat stel om in 'n aantal bateklasse te belê. Beleggers kan kies tussen planne met 'n lae risiko, mediumrisiko en hoërisikoplanne, afhangende van hul vlak van risikotoleransie. Daar is ook beperkings op hoeveel 'n belegger in elke soort plan kan belê. Die laagste risiko-plan word aangebied aan diegene wat die risiko wil verminder, terwyl die plan met die hoogste risiko beskikbaar is vir beleggers wat 'n stabiele inkomste wil genereer.

Kwanloop invests in projects as collateral for the money that it lends to investors. This helps avoid complicated legal structures that can complicate collateral management. Kwanloop manages a diverse portfolio of investments, and its investors are guaranteed a return on their investment.

Dit bied diversifikasie volgens risikofaktor.

Investing platforms like Kwanloop offer their users diversification by risk factors. These diversification plans are designed to minimize the risk that an investor faces without sacrificing any of the returns. Most platforms offer automatic or manual diversification. These plans allow you to choose an investment based on your background, interest target, and investment time frame. When it comes to risk factor diversification, Kwanloop takes the process a step further.

Risikofaktore word in verskillende kategorieë gekategoriseer, insluitend maatskappyspesifieke risiko's. Maatskappye kan blootgestel word aan risiko's weens aard, wetgewing en verbruikersvoorkeure. Byvoorbeeld, lugdiensaandele is kwesbaar vir dieselfde risiko's wat ander soorte beleggings beïnvloed. Om die risiko van hierdie risiko's te verminder, is dit belangrik om buite die lugdiensbedryf te diversifiseer.

Dit bied nie 'n terugkoopwaarborg nie.

In a nutshell, Kwanloop does not offer a money-back guarantee on its investments. Instead, it operates a proprietary alternative lending platform that brings together commercial borrowers and loan investors. In other words, it acts as a wholesale funding source for business customers.

Kwanloop offers investors three investment plans. Low, medium, and high-risk The low-risk plan is for the most conservative investors, and the high-risk plan is for those who are comfortable with a high degree of risk. However, investors are not allowed to allocate all of their investments to the high-risk plan. Instead, they are allowed to allocate up to 50% of their funds to the medium or high-risk plan. This prevents them from taking a disproportionate amount of risk.

Bemeestering van digitale finansies: 'n omvattende gids

Bemagtig u finansiële toekoms: gryp u eksemplaar van 'Mastering Digital Finance' e -boek en navigeer die kompleksiteite van moderne finansiële landskappe met vertroue!

Kry u e -boek

If Kwanloop cannot buy your investment back, they will use the funds to cover their costs of money transfer. You will not be charged for the buyback guarantee.

Dit bied 'n 24-uur-model om beleggers likiditeit te bied.

Kwanloop uses a 24-hour model to give investors access to money at a moment's notice. The company pools its investors' capital and automatically breaks it down into single loans of 1 euro each. Upon expiry, the money is repaid in full. The 24-hour model provides investors with a steady stream of income without the need to worry about investment risk or inflation.

The company promotes responsible and sustainable investments and focuses on risk diversification. Kwanloop's 24-hour model allows investors to make the appropriate amount of investment, and even if they choose a high-risk plan, they can still make a decent IRR. It offers three risk plans, and investors set their risks upfront. The low-risk plan has an interest rate of 5.5% per annum; the medium-risk plan offers a return of 9%, and the high-risk plan has a return of 13%.

Dit is nie belastingbewoners in Estland nie.

Belastingbesidentstatus in Estland is 'n wettige konsep wat nie-Estlandse ondernemings in staat stel om soos plaaslike ondernemings te werk, maar steeds belasting in hul vaderland te betaal. 'N Fiktiewe belastingkoshuis is slegs van toepassing op inkomste wat in Estland gemaak is. Dit sluit sake -inkomste, casino -winste, huurwins op vaste eiendom en sekere lisensieverdienste in. Dit is egter nie van toepassing op Kwanloop se beleggings nie.

Belegging in Kwanloop hou verskeie voordele in, waaronder hoë-rentekoerse, 'n cashback-program en inflasieveilige beleggings. Dit is 'n belastingdoeltreffende oplossing wat buitelanders en plaaslike Estoniërs in staat stel om in 'n aantreklike bateklas te belê. Kwanloop laat ook nie-Estoniërs toe om verwysingsinkomste te verdien, wat 'n uitstekende manier is om verliese weens inflasie te vergoed.

Bemeestering van digitale finansies: 'n omvattende gids

Bemagtig u finansiële toekoms: gryp u eksemplaar van 'Mastering Digital Finance' e -boek en navigeer die kompleksiteite van moderne finansiële landskappe met vertroue!

Kry u e -boek