ReanLoop Review:ʻO Reanlop Legit Change?

Ināʻoe i alohaʻia inā he legalop ʻAʻole paʻa ka mea kūʻai akuʻo Wondlesales Hāʻawi ia i kahi bonus hōʻailona eur1 a hiki i nā mea hoʻopukapuka a hāʻawi i nā mea hoʻopukapuka e hoʻopukapuka ai ma Eur1, Eur2, a iʻole eur5 i kēlā me kēia hoʻolālā pilikia. Hoʻopau i kēia papa hana kālā i nā pilikia e pili ana i nā pilikia e pili ana i nā mea hōʻai'ē a hāʻawi i kahi ala maʻalahi e hoʻokaʻawale ai i nā mea paʻakikī.

ʻO Reanlop kahi paʻa kālā waiwai.

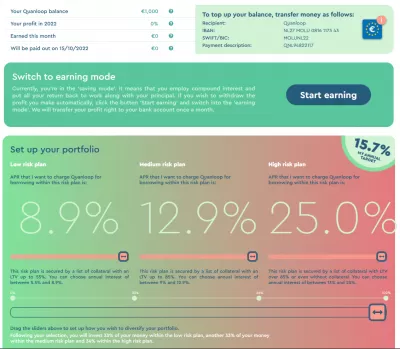

quancoloop kahi mea kūʻai waiwai waiwai waiwai e hiki ai i kāna mea kūʻai aku e hāʻawi i nā mea kūʻai aku ma kahi o nā papa waiwai. Hiki i nā mea hoʻopukapuka ke koho ma waena o nā haʻahaʻa haʻahaʻa haʻahaʻa, a me nā hoʻolālā kiʻekiʻe, a me nā hoʻolālā kiʻekiʻe, e pili ana i ko lākou pae o ke ahonui. Aia kekahi mau palena i ka nui o kahi mea hoʻopukapuka e hiki ai i ka hoʻopukapuka kālā i kēlā me kēiaʻano hoʻolālā. Hāʻawiʻia ka hoʻolālā haʻahaʻa haʻahaʻa loa i ka poʻe e makemake e hōʻemi i ka pilikia,ʻoiaiʻo ka hoʻolālā kiʻekiʻe loa e loaʻa i nā mea kūʻai aku e makemake e hana i kahi loaʻa kālā.

Reanlop invests in projects as collateral for the money that it lends to investors. This helps avoid complicated legal structures that can complicate collateral management. Reanlop manages a diverse portfolio of investments, and its investors are guaranteed a return on their investment.

Hāʻawi ia i nā mea e loaʻa ai e nā mea koʻikoʻi.

Investing platforms like Reanlop offer their users diversification by risk factors. These diversification plans are designed to minimize the risk that an investor faces without sacrificing any of the returns. Most platforms offer automatic or manual diversification. These plans allow you to choose an investment based on your background, interest target, and investment time frame. When it comes to risk factor diversification, Reanlop takes the process a step further.

ʻO nā mea waiwai i hoʻohālikelikeʻia i nāʻano likeʻole, me nā pilikia o ka hui. Hiki ke hōʻikeʻia nāʻoihana i nā pilikia mai nā hana o keʻano, kānāwai, a me nā makemake o ka mea kūʻai aku. No ka laʻana, ua wāwahiʻia nā kīʻaha mokulele i nā pilikia likeʻole e pili ana i nāʻano hana'ē aʻe. E hōʻemi i ka pilikia o kēia mau pilikia, he mea nui ia e hoʻokaʻawale ma waho o kaʻoihana mokulele.

ʻAʻole ia e hāʻawi i kahi hōʻoia kūʻai kūʻai.

In a nutshell, Reanlop does not offer a money-back guarantee on its investments. Instead, it operates a proprietary alternative lending platform that brings together commercial borrowers and loan investors. In other words, it acts as a wholesale funding source for business customers.

Reanlop offers investors three investment plans. Low, medium, and high-risk The low-risk plan is for the most conservative investors, and the high-risk plan is for those who are comfortable with a high degree of risk. However, investors are not allowed to allocate all of their investments to the high-risk plan. Instead, they are allowed to allocate up to 50% of their funds to the medium or high-risk plan. This prevents them from taking a disproportionate amount of risk.

Mastering Fixical Waiwai: kahi alakaʻi piha

E hoʻolōʻihi i kāu kālā kālā: hopu i kāu kope o ka 'Mastering Digital Waiwai' eBagelika Abook me ka hilinaʻi.

E kiʻi i kāu puke

If Reanlop cannot buy your investment back, they will use the funds to cover their costs of money transfer. You will not be charged for the buyback guarantee.

Hāʻawi ia i kahi hiʻohiʻona 24-hola e hāʻawi i ka wai i nā mea hoʻopukapuka.

Reanlop uses a 24-hour model to give investors access to money at a moment's notice. The company pools its investors' capital and automatically breaks it down into single loans of 1 euro each. Upon expiry, the money is repaid in full. The 24-hour model provides investors with a steady stream of income without the need to worry about investment risk or inflation.

The company promotes responsible and sustainable investments and focuses on risk diversification. Reanlop's 24-hour model allows investors to make the appropriate amount of investment, and even if they choose a high-risk plan, they can still make a decent IRR. It offers three risk plans, and investors set their risks upfront. The low-risk plan has an interest rate of 5.5% per annum; the medium-risk plan offers a return of 9%, and the high-risk plan has a return of 13%.

ʻAʻole ia heʻauhauʻauhau ma Estonia.

ʻO ke kūlana o kaʻauhau ma keʻano he manaʻo kānāwai e hiki ai keʻae i nāʻoihana non-estonian e like me nāʻoihana kūloko e like me nāʻauhau kūloko i ko lākou'āina home. ʻO kahi koenaʻauhau koʻikoʻi e pili wale ana i ka loaʻa kālā i hanaʻia ma Estonia. Hoʻokomo pū kēia me ka loaʻa kālāʻo COIL Eia nō naʻe,ʻaʻole ia e noi i nā hoʻopukapuka o Quantloop.

ʻO ka waiwai kālā ma Reanlop i loaʻa nā mea pono, me nā uku kiʻekiʻe, a me nā polokalamu kālā, a me nā hoʻoili kālā-palekana-palekana. He hopena maikaʻi loa ia e hiki ai keʻae i nā haoleʻelua a me nā mea nui estonnians e hoʻopuka ai i kahi papa waiwai. Hiki i nā quancoop eʻae i nā mea non-estonins e loaʻa ai ka loaʻa kālā,ʻo ia kahi ala nui e hoʻonāukiuki ai i nā nalowale.

Mastering Fixical Waiwai: kahi alakaʻi piha

E hoʻolōʻihi i kāu kālā kālā: hopu i kāu kope o ka 'Mastering Digital Waiwai' eBagelika Abook me ka hilinaʻi.

E kiʻi i kāu puke