40+ Expert Tips To Make A Tax Free Charity Donation

- Editor’s tip: we used technology to donate a full week of passive income, tax free!

- Consider donating to a 501(c)(3) organization

- Know the types of donations you can deduct

- When in doubt, work with a professional

- Donations to individuals are ineligible

- Obtain a receipt even while paying in cash

- Consider payroll deductions

- Consider incentives

- Consider gifting appreciated assets

- Time isn't deductible

- Join your cash and stock holdings for a bigger deduction this year

- Record your gift's value

- Donor Advised Fund

- Valuable Assets

- Getting the Most Out of Tax-Free Donations

- Contributing to nonprofits that you care about without incurring any tax consequences is a win-win situation

- Make sure the organization is qualified

- Understand the limits of deductions

- Document the value of your gift

- Consider a donor-advised fund for philanthropic contributions

- Remember that donations to individuals will not qualify for a tax deduction

- Donate to charity to offset capital gains generated by asset allocation rebalancing

- Think of donating appreciated property

- Make a Donation Plan

- Home items for donation

- Donations made to private people are not tax deductible

- Find out how much of your donation you can write off (and what documentation is needed)

- Obtain proof of purchase receipt

- Donating to charity is a great way to give back and support a good cause

- Itemize your deductions

- Donate appreciated securities

- Give through a 501(c)(3) non-profit organization

- There are a few ways to donate to charity tax free

- Make sure you are donating to a qualified charitable organization

- Use a Donor Advised Fund (DAF)

- Use a charitable giving vehicle

- Keep track of all your donations throughout the year

- The easiest way is to give money directly to the charity

- Many people are hesitant to give money to charity because they don't want to pay taxes on the donation

- First, make sure to select a charity that is aligned with your personal values

- Stock or bond donations

- The first thing to remember is that this varies depending on the country and city you live

- Do it through a donation matching program

- Give appreciated assets, such as stocks or real estate, instead of cash

- You need to donate to tax-exempt organizations like the Red Cross and other non-profit institutions

- Make a charitable contribution through a Donor Advised Fund (DAF)

- Participate in the government’s tax-deductible program

- Give to a qualified charitable organization

- You can donate to charity without thinking about tax obligations

- Give through a donor-advised fund

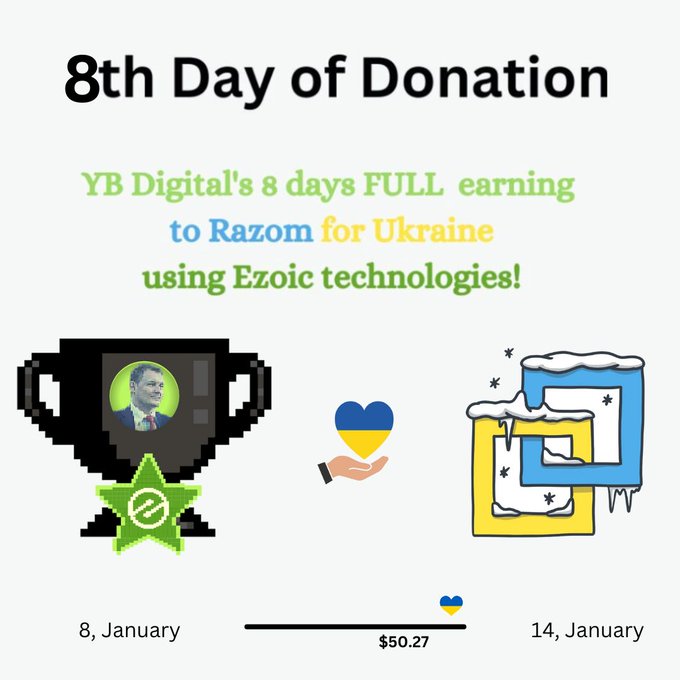

Editor’s tip: we used technology to donate a full week of passive income, tax free!

Using groundbreaking technology, it is now possible to donate to selected organizations some of your passive income, if you are displaying advertisement on your websites.

We have used it to donate tax free some of our earnings in the past, a full day of passive income on Christmas day, and are using it again to donate passively and tax free, as the money donated has not been transferred to us and therefore is not eligible for taxation.

To get there, all we had to do was to donate the amount equal to our passive earnings for a selected period, we chose the symbolic period from Orthodox Christmas to Orthodox New Years Eve, 8 days in total, or about 2.2% of our yearly income, and donated that amount to a charity!

The charity chosen for this event is Razom for Ukraine as they are responding to the war in Ukraine, an event that we unfortunately been personally affected, as we are living nearby and many of our acquaintances are very much affected by it.

Therefore, using this simply technology trick, we could easily double our donation target, passively, tax free, without hassle, and can communicate about it, as we’ve been the first business ever to do such an operation!

Consider donating to a 501(c)(3) organization

Or another charity that is exempt from paying taxes if you want to avoid paying taxes on the money you donate. When you make this kind of contribution, your contribution can be deducted from the income that is subject to taxation on your federal income tax return. In addition, a few states offer tax credits for donations made to charity organizations. If you want to find out the particular effects your gift will have on your taxes, you should discuss this matter with an experienced tax specialist.

Know the types of donations you can deduct

In my opinion, in addition to monetary donations such as cash, credit, and checks, you can also claim tax deductions on given items and personal property such as vehicles, jewelry, art, and even stocks, patents, and real estate. This is in addition to the tax breaks that are available for monetary donations. Check to see that the value assigned to noncash contributions corresponds to their true value in the market. When you donate stocks, you are eligible to receive a tax deduction equal to the full fair market value of those stocks, with the possibility that this deduction would increase by more than 20%.

When in doubt, work with a professional

I would say, that if you suspect that your plan for giving to charity may have tax ramifications, you should seek the opinion of a specialist before moving forward with it. Discuss the possibility of receiving a tax break as a result of your charitable contributions with a tax specialist, as well as the specifics of the documentation that will be required.

Donations to individuals are ineligible

No deductions can be made for gifts to specific individuals, no matter how deserving they may be. Helping the homeless and collecting donations for people in need are also examples (including pooled funds for folks who are ill or have experienced a tragedy such as an accident or fire). If you care about the deduction, it's best to coordinate your efforts through a well-known relief agency like the Red Cross.

Obtain a receipt even while paying in cash

Any cash deductions, no matter how small, need to be supported by either bank records (like a canceled check or credit card receipt, labeled with the name of the charity) or written confirmation from the organization. There must be a record of the donation's date, its monetary value, and the charity that received it. If you donate $250 or more to an eligible nonprofit, you must receive a receipt from that organization in order to deduct your donation. Always request a receipt when making a donation; any reputable charity will gladly provide one upon request. While supporting documents are not required at the time of filing your tax return, you should have them available in the event of an audit.

Consider payroll deductions

Employees are relying more and more on the opportunities offered by their employers. If you choose to make a donation through payroll deduction, you must keep both the pledge card and the pay stub, W-2, or other document provided by your employer that shows the total amount withheld as a charitable donation in order to comply with record-keeping requirements set forth by the Pension Protection Act of 2006. If you are a federal employee, you can fulfill these criteria by using a pledge card that clearly displays the name of a Combined Federal Campaign.

Consider incentives

Only the portion of a contribution that is in excess of the value of any consideration received is tax deductible. You can deduct the amount of your donation that is not covered by the value of the item you received in exchange for it, such as a coffee mug or a supper. Don't assume anything about the worth of a gift until you ask about it. The majority of organizations that accept donations will calculate the total worth of your contribution and include that information on the letter of appreciation or receipt you receive.

Consider gifting appreciated assets

One can reap double the advantage from a donation of shares or other property that has increased in value. If you've owned the property for at least a year, you can deduct its current market value without having to pay capital gains tax. While the sale of a valued asset often triggers capital gains taxation, gifts to qualified charities are exempt from this rule.

Time isn't deductible

Offering your services pro bono is not something you can deduct from your taxes. The good news is that as long as they are not compensated or considered personal in character, most out-of-pocket expenses related to volunteering are deductible. Transportation costs (including parking and tolls), travel costs, the cost of uniforms or other apparel worn in the performance of the charitable activity, and the cost of goods utilized in the performance of charity service may all be tax-deductible outlays. In the same way, you would with any other kind of donation, proper documentation is essential.

Join your cash and stock holdings for a bigger deduction this year

Contributions in long-term appreciated assets can reduce your tax bill by eliminating your long-term capital gains exposures, but you can only deduct up to 30% of your AGI if you itemize your deductions. Most people won't need more than this, but there are years when a higher deduction in the current year could be helpful. Donating securities to charity is great, but there are times when you may want to add a monetary donation as well. The tax savings you can get through this method of coordinated giving are substantial.

Record your gift's value

Maintaining accurate records is crucial in making a charitable contribution, but it is of utmost significance when dealing with gifts other than monetary ones. The worth of your contribution must be verifiable. Fair market value is what an item would sell for if it were in good condition today, so that's the amount you can deduct, but you'll need to be able to prove that it's worth that much. If the donation is worth less than $500 and you are keeping track of it yourself, be as detailed as possible by writing down what the items are and how they are. If the property's contribution is more than $5,000, it needs to be formally appraised to find out what its fair market value is. Contributions of property other than cash (usually those over $500) may additionally necessitate the completion of a portion of Form 8283.

Limits may applySome taxpayers may not know that there are restrictions on the amount they can deduct from their charitable contributions. If your contributions are more than 20% of your adjusted gross income, you need to watch out for limits. Even though the specific rules are often complicated and subject to exceptions, here are some general rules: Cash contributions up to 50% of AGI are deductible, as are non-cash assets up to 30% of AGI, and appreciated capital gains assets up to 20% of AGI. The terms of any peace agreements you make could also make it harder for you to give money. Overcontributing may necessitate the use of carryovers.

Donor Advised Fund

Make a charitable contribution to a qualified organization through a Donor Advised Fund, and you can reduce or eliminate the need to pay taxes on the amount of your contribution to a nonprofit organization (DAF). A Donor Advised Fund (DAF) allows you to make a donation to charity and earn an instant tax credit. In addition, you have the ability to instruct the DAF on how and when the monies should be distributed to the charities of your choosing.

Valuable Assets

Donating valuable assets such as stocks or real estate directly to an organization that meets the requirements to receive tax-deductible donations is still another technique to sidestep having to pay taxes on charitable contributions. When you give assets that have increased in value over time, you can typically claim a tax deduction equal to the item's current fair market value and avoid paying tax on the appreciation of the asset as a result of the donation.

Getting the Most Out of Tax-Free Donations

Giving to charity is a terrific way to help the causes and organizations you care about while lowering your taxable income. What I mean by tax-free donations is that money given to some charities doesn't count as income for tax purposes. To make the most of tax-deductible contributions, though, you need to be familiar with the laws that govern them. One approach to get the most out of tax-deductible gifts is to give to a nonprofit that qualifies. To qualify, a group must be officially recognized as a charity or non-profit.

The tax benefits of charitable giving can be increased by careful financial planning. To maximize your deductions, you may want to explore combining gifts from numerous years into a single tax filing. If you anticipate a larger income in the future, this strategy can help you save money by allowing you to take advantage of more deductions at a time when your income is smaller. Gifts of valued assets, such as stocks, can give an extra tax advantage above cash donations.

Contributing to nonprofits that you care about without incurring any tax consequences is a win-win situation

It is vital to understand the laws and restrictions governing tax-free gifts, however, to ensure that your contributions are eligible for tax purposes. If you want your donation to be tax-deductible, check to see if the charity it's going to is qualified to receive such contributions. Only charities and non-profits that are legally recognized as such can apply. To verify a charity's tax-exempt status, you may look them up on the IRS's website or the site of your country's equivalent government agency.

One further thing to remember when giving to charity without paying taxes is to keep detailed records. The date, the amount, and the organization's official receipt for the contribution must be recorded and kept. Keep all receipts, bills, and bank statements as proof of payment. The deductions may then be claimed on your tax return with this information in hand, saving you from any possible problems with the IRS. More than $500 in donations requires filing form 8283. With these guidelines in mind and an awareness of the laws and regulations regarding tax-free donations, you can make sure your gifts are fully deductible and have a bigger impact on the causes and organizations you care about.

Make sure the organization is qualified

Before making a donation, be sure to confirm that the organization is a qualified charitable organization. This means that the organization is tax-exempt under section 501(c)(3) of the Internal Revenue Code. You can check the IRS’s Exempt Organizations Select Check tool to confirm the status of an organization.

Understand the limits of deductions

There are limits on the number of charitable donations that can be claimed as deductions. For cash donations, the deduction is limited to 60% of your adjusted gross income. For non-cash contributions, such as property or securities, the deduction is limited to 30% or 50% of your adjusted gross income, depending on the type of property and the organization.

Document the value of your gift

Even more so for non-cash donations, good records are crucial when it comes to charitable giving. Fair market value, which is frequently regarded as the price that a willing buyer would pay a willing seller, is typically deductible from your income. You'll want to be able to calculate an appropriate value while keeping that in mind.

Consider a donor-advised fund for philanthropic contributions

Consider a donation fund regardless of the assets you give. It's a simple and tax-efficient way to donate money to a charity: you donate cash or other assets, become eligible for a tax deduction because the donor-advised fund is a program of a public charity, and then recommend which qualified charities you would like to support. The timing is flexible, and you can support as many charitable causes as you like. A donor-advised fund, such as the Giving Account at Quality and Performance Compassionate, offers an additional benefit: the opportunity to recommend how your contribution is invested for potential tax-free growth, which could provide additional long-term nonprofit support.

Remember that donations to individuals will not qualify for a tax deduction

No matter how deserving, payments to specific people cannot be deducted. This includes providing food to the homeless and collecting money from clients or neighbours who are struggling (including pooled funds for folks who are ill or have experienced a tragedy such as an accident or fire).

Donate to charity to offset capital gains generated by asset allocation rebalancing

Many astute investors regularly rebalance their portfolios to ensure that their investment mix is consistent with their objectives. This frequently involves selling investments that have performed well, which generates capital gains taxes.

Aligning your contributions with the process of rebalancing is a straightforward method of offsetting. Instead of writing a check to a favorite charity this year, consider donating your most valuable security, which you have held for over a year, and which has appreciated significantly. Typically, neither you nor the charity receiving the donation is subject to capital gains taxes, and because you did not write a check, you may have cash available to purchase additional stocks as part of your rebalancing exercise.

Think of donating appreciated property

Giving valued property away can be advantageous from a tax perspective because you will not only be able to deduct the donation from your taxes but you will also not have to pay capital gains tax on the appreciation. This is how it goes. Let's say you want to give $1,000 worth of appreciated stock to a charitable organization. You will be required to pay tax on the appreciation, which in this example is $9,000, if you sell the stock before donating it. You will have to pay $1,350 in taxes, leaving you with $8,650 in after-tax gains if you estimate a 15% capital gains tax rate, which is the long-term rate for the majority of taxpayers. You can deduct $8,650 from your income for charitable purposes if you donate that much.

Instead, if you gave the charity $10,000 worth of appreciated stock in a direct donation, the charity would keep the whole sum and would not be subject to tax. In addition, you would be eligible for the full $10,000 tax donation and would not owe any capital gains tax. Depreciated assets do not yield the same results. Selling first before making the contribution may make sense if the value of your assets has decreased. You can then still use the leftover charitable deduction while protecting the capital loss.

Make a Donation Plan

In order to maximise your deduction for charitable contributions, you can take advantage of a number of tax planning strategies. Taking a deduction in one year instead of the next may make sense if you expect to be in a higher tax band in the coming year. Planning ahead for large donations to charity will help you get the most out of your tax deduction while spending as little as possible out of your own wallet.

If you itemise your taxes this year and donate 60 per cent of your income, or $15,000, to charity, you will obtain a tax deduction for the full amount of your donation, and the money you save will go toward covering the cost of your gift. Any donations in excess of $15,000 will be carried over to the following year's tax return, delaying any tax savings until the following year.

Home items for donation

Donating household items is a great way to help others, reduce your taxable income, and clean out your basement all at once. Donated clothing and household goods are often distributed or sold by many charitable and religious groups. There are tighter restrictions on in-kind contributions than on monetary ones. When donating items, you can use the fair market value you determine at the time of the donation rather than the original price you paid. Even if the amount of your donation is less than $250, you should still request a receipt in writing from the charity and document it with a detailed inventory of the items you gave. A contemporaneous written acknowledgement from the organisation is required for donations between $250 and $500. Donations of $500 or more, but less than $5,000, require filing IRS Form 8283 in addition to receiving an appreciation letter. In addition to the appreciation and Form 8283, donations of commodities valued at more than $5,000 also need a formal assessment.

Donations made to private people are not tax deductible

Whatever the merits of the recipient, payments to an individual cannot be deducted. Giving to the homeless and taking up a plate at work or in the community are two examples of this (including pooled funds for folks who are ill or have experienced a tragedy such as an accident or fire). If you care a lot about the deduction, it could be best to team up with a well-known disaster relief group like the Red Cross.

Find out how much of your donation you can write off (and what documentation is needed)

Generally speaking, donations are tax deductible in their entirety, although a receipt is required for any amount above $250. If you make a donation in cash instead of by credit card or check, the recipient must provide you with a receipt or bank statement showing the amount of your donation. As was previously indicated, the whole sum based on current market value can often be removed for physical objects like clothing or paintings. It may be necessary to get a professional valuation for some items.

Obtain proof of purchase receipt

In fact, for cold hard cash. All monetary contributions, no matter how little, must be supported by a cancelled check or credit card receipt bearing the donor's name and the charity's name. Clearly stating the donation's date, amount, and recipient organisation in writing is required. All donations of $250 or more require a receipt from the charity before you may deduct the amount from your taxes. Asking for a receipt after making a donation is a good idea because most nonprofits would gladly provide one. You are not required to include this with your tax return, but you should have it ready in the event that the IRS requests it.

Donating to charity is a great way to give back and support a good cause

But it can be difficult to avoid paying taxes on your donation. There are a few ways that businesses can leverage this tip to support the charity of their choice or promote a PR event.

One way that businesses can support charity is by donating money directly to the charity. This allows the business to avoid paying taxes on the donation, as well as giving the charity a bit of extra cash.

Another way that businesses can support charity is by donating goods and services to the charity. This allows the business to benefit from tax breaks, as well as promoting their brand or product.

Finally, businesses can participate in fundraising events for the charity. This allows them to generate awareness and support for the charity, while also collecting donations from customers.

Itemize your deductions

When it comes time to file your taxes, be sure to itemize your deductions and include your charitable donations. By following these simple tips, you can make a tax-free charity donation with ease! Cindy Liang CEO of Custom Medals And Pins.

Donate appreciated securities

One way is to donate appreciated securities, such as stocks or mutual funds, to a qualified charity. When you donate appreciated securities that you have held for more than one year, you can take a deduction for the full market value of the securities on the date of the gift and avoid paying any capital gains tax. James Allen Founder of Billpin.com

Give through a 501(c)(3) non-profit organization

This type of organization is exempt from income tax, so any donations made are also excluded from taxation.

Businesses can leverage this tip by using their resources to make charitable donations. Whether through a direct gift or by hosting an event to raise money for their chosen charity, businesses can benefit financially and socially from supporting philanthropic activities.

Furthermore, businesses can use this as an opportunity to promote their own brand through PR events or even by starting their own non-profit organizations. Not only will this further extend the reach of their own brand, but it will also benefit society in a meaningful way.

There are a few ways to donate to charity tax free

The simplest way is to donate cash. However, if you donate appreciated stock or property, you can avoid paying taxes on the increase in value of the asset. You can also donate your time and services to charity tax free.

Businesses can donate to charity tax free by giving cash, stock, or property. Businesses can also donate their time and services. However, there are some restrictions on the tax deduction for businesses. Businesses can only deduct the cost of goods or services donated, not the value of the donation.

Donating to charity is a great way to support a good cause and get a tax deduction. You can donate cash, stock, or property and get a tax deduction for the fair market value of the donation. You can also donate your time and services and get a tax deduction for the cost of the goods or services donated.

Make sure you are donating to a qualified charitable organization

Charitable organizations are typically exempt from federal income tax under section 501(c)(3) of the Internal Revenue Code. To ensure you are donating to a qualified organization, you can search the IRS website or visit the charity’s website.

Another great tip to donate to charityWithout paying taxes is to donate appreciated assets such as stocks or mutual funds. When you donate these assets, you can avoid paying capital gains taxes on their appreciation. Donating appreciated assets is a great way to maximize the value of your donation while minimizing the tax consequences.

Businesses can leverage these tips to support the charityOf their choice or promote a PR event. For example, businesses can donate appreciated assets such as stocks or mutual funds to the charity of their choice. This allows them to maximize the value of their donation while minimizing the tax consequence. Additionally, businesses can leverage their PR events to promote their donations to the charity. For example, businesses can host press conferences or write press releases to spread the word of their charitable donation and the cause they are supporting.

Ultimately, donating to charity is a great way to make an impact and to helpSupport a cause that you believe in. By utilizing the tips mentioned above, businesses can donate to charity without paying taxes and can also leverage PR events to promote their donations. This can be a great way for businesses to give back to the community and make a positive impact on the lives of others.

Use a Donor Advised Fund (DAF)

One of the best tips to donate to charity without incurring taxes on the donation is to use a Donor Advised Fund (DAF). A DAF is an account that allows individuals, families, and businesses to make charitable donations and receive a tax deduction for the donated funds. The individual or business can then make grants from the fund to multiple different charities of their choice over time. Businesses in particular can leverage this tip to support the charity of their choice or promote a PR event because they can spread out their donations over time while still receiving an immediate tax benefit.

Use a charitable giving vehicle

A donor-advised fund is a charitable giving vehicle in which individuals or businesses can make tax-deductible donations into an account and then recommend grants to qualified charities over time. Donations made through a donor-advised fund are immediately deductible in the year they are made, providing the potential for tax savings; however, donors can take their time when deciding which charity or charities should receive their grant recommendations. Donor-advised funds provide donors with flexibility and control over their philanthropic investments and may give them the ability to leverage their resources more effectively than if they were donating directly.

How can businesses leverage this tip to support the charity of their choice or promote a PR event?Businesses can leverage this tip by establishing their own donor-advised fund or contributing to one already set up by another organization. By creating a dedicated fund, businesses can designate specific programs or initiatives that they would like to support while also offering other organizations an opportunity to contribute. Businesses could also use donor-advised funds as part of a PR event by providing matching donations for any funds donated during the event. This encourages more people to participate in the event and makes it easier for businesses to show their commitment to supporting charitable causes.

Keep track of all your donations throughout the year

Important tip is to keep track of all your donations throughout the year. When it comes time to file your taxes, you’ll need documentation of every contribution you made in order to take advantage of any deductions. Furthermore, if you donate goods instead of cash, it’s important to have an accurate record of what was donated and its value. If possible, get a receipt from the charity for your donation as well.

The easiest way is to give money directly to the charity

Another option is to donate gift cards or vouchers. You can also make a donation through your employer's foundation or donation account.

Finally, you can make a donation through crowdfunding platforms like Kickstarter or Indiegogo.All of these methods have the advantage of allowing you to choose the charity of your choice and support them directly.

This means that the money you donate goes straight to the charity and isn't subject to tax.This gives charities an extra incentive to receive donations from individual donors, since they don't have to worry about any taxes being levied on their donations.

Businesses can also leverage this tip to promote a PR event or support a specific cause that they believe in. For example, Apple could use their fundraising power to mobilize support for cancer research by donating products to various cancer charities through their charitable giving program.

Many people are hesitant to give money to charity because they don't want to pay taxes on the donation

There are a number of ways that businesses can leverage this tip to support the charity of their choice or promote a PR event. For example, businesses can sponsor a charity walk or bike ride, give a percentage of sales to a charity, or make a donation to a charity through their company's foundation.

Whatever way you choose to give to charity, make sure to do it legally and with a sense of purpose. By donating to a worthy cause, you're helping to make a difference in the world and have a positive impact on someone's life.

First, make sure to select a charity that is aligned with your personal values

Second, consider donating through a charitable foundation. This way, your donation will be tax-deductible.

Finally, consider donating through a donation drive or event sponsored by your business. This way, your company can promote its charity work and support a good cause at the same time.

Stock or bond donations

If you want to increase the value of your donation-and increase your tax deduction-give stocks, bonds, or other appreciated securities directly to your favorite charity. It may be quick and easy to write a check or give via credit card, but cash gifts are generally less tax-efficient. Charity can benefit from appreciated assets in a couple of ways:

You may have to pay capital gains tax if you sell an appreciated security. You, and the charity, can avoid capital gains taxes by giving appreciated securities to a charity. Additionally, your AGI will be reduced by 30% when you donate the security, up to the fair market value.

As an example, Alex purchased $100 worth of DEF Company stock years ago. There is now a $1,000 value on the share. The charitable income tax deduction he would have qualified for had he sold the stock himself would have been $900, not $1,000. By giving the share to his favorite charity, Alex could qualify for the charitable income tax deduction of $1,000.

The first thing to remember is that this varies depending on the country and city you live

The first thing you should do is find out specific details on your actual area, instead of looking at broad parameters related to claiming your charitable donations.

Next, do whatever you can to make the most out of donating by claiming all of your charitable donation tax credits. In some places, you can claim up to 75% of your yearly net income in eligible donations. But before you start donating, check the charities legitimacy through the IRS' database. If you want to deduct your donations through taxes, the charity must be legitimate.

Once you have your local rules, have found out more about the organization you want to donate to, and made a plan, you should be good to start donating!”

Do it through a donation matching program

This program allows you to give a certain amount of money to a charity and then have your employer match your donation. In this way, you can take advantage of a tax benefit while also giving more money than you would have otherwise.

This method is especially useful for businesses that want to support their local charities or promote a PR event. For example, if your company wants to support local arts education programs or help clean up the city streets, then donating through a matching program will allow you to do both!

Give appreciated assets, such as stocks or real estate, instead of cash

When you donate appreciated assets that you've held for more than a year, you can deduct the full fair market value of the assets on your tax return, and you won't have to pay capital gains taxes on the appreciation.

Another tip is to set up a Donor-Advised Fund (DAF) account. A DAF is a charitable giving vehicle that allows donors to make a charitable contribution, receive an immediate tax deduction, and then recommend grants to their favorite charity or charities over time. It is a simple, flexible and tax-efficient way to support your favorite causes.

For businesses, they can leverage this tip by donating appreciated assets or setting up a DAF account. They can also consider matching employee donations to charity or starting a volunteer program where employees can volunteer their time to the charity of their choice. This not only helps to support the charity but also promotes a positive image of the business.

In addition, businesses can also organize charity events or fundraisers and invite their customers, suppliers, and community to participate. This can be a great way to raise awareness for a specific cause and also create a positive public relations event for the company.

You need to donate to tax-exempt organizations like the Red Cross and other non-profit institutions

By donating to these organizations, you will qualify for tax deductions. Verify the organization's status as per the rules of the IRS before donating.

The business will be in a better position to hold charitable events. It helps create goodwill in the industry. When a business sponsors and donates to a tax-exempt or non-profit organization, it gives recognition and builds the brand's name.

Make a charitable contribution through a Donor Advised Fund (DAF)

One way to donate to charity without paying taxes on your donation is to make a charitable contribution through a Donor Advised Fund (DAF). A DAF is a type of charitable giving vehicle that allows individuals, families, or businesses to make a charitable contribution, receive an immediate tax deduction, and then recommend grants to their favorite charities over time. Businesses can leverage this tip by setting up a DAF and making charitable contributions to it, which they can then recommend to the charity of their choice or use to promote a PR event. This allows the business to receive a tax deduction for the contribution while also supporting the charity of their choice or promoting a PR event.

Participate in the government’s tax-deductible program

Under this program, businesses can take advantage of charitable donations and get a generous tax break for their contribution. It is important that businesses comply with all relevant laws when making donations, such as keeping accurate records of the amounts donated and ensuring that the charity receiving the donations is a registered nonprofit.

Businesses can also leverage their donations to support causes they feel passionate about or to promote a PR event. For example, by donating to a particular charity, the business can gain media attention and a positive public image for itself. This can be especially effective for businesses looking to promote a cause, such as a charity or philanthropic event.

Give to a qualified charitable organization

In the United States, donations to certain qualified organizations, such as 501(c)(3) nonprofits, are tax-deductible. To claim a deduction for charitable donations on your income tax return, you must *itemize* your deductions and have a receipt or other written documentation from the charity.

Donating appreciated assetsSuch as stocks or real estate can also provide a double tax benefit.Not only do you avoid paying capital gains tax on the appreciation, but you also get a charitable deduction for the full fair market value of the asset.

You can donate to charity without thinking about tax obligations

Being careful to maintain thorough documentation of your gifts is one method. This entails retaining invoices, canceled cheques, or other records that list the gift value and the name of the recipient institution. You may only deduct the market value of non-cash donations like furniture or apparel, so you should conduct some study or get the item evaluated before donating.

Give through a donor-advised fund

This allows you to make a tax-deductible contribution, invest the funds in the stock market, and then decide which charitable organizations will benefit from the proceeds. You can make a single donation or set up ongoing contributions.

Businesses looking to leverage this tip for their own benefit can encourage employees and customers to donate through their donor-advised fund by offering incentives – such as discounts or special perks for those who make donations. Businesses can also set up their own fund and designate a charity or cause to benefit from the proceeds. By doing this, businesses can promote a PR event and demonstrate their commitment to social causes while also getting a tax deduction.