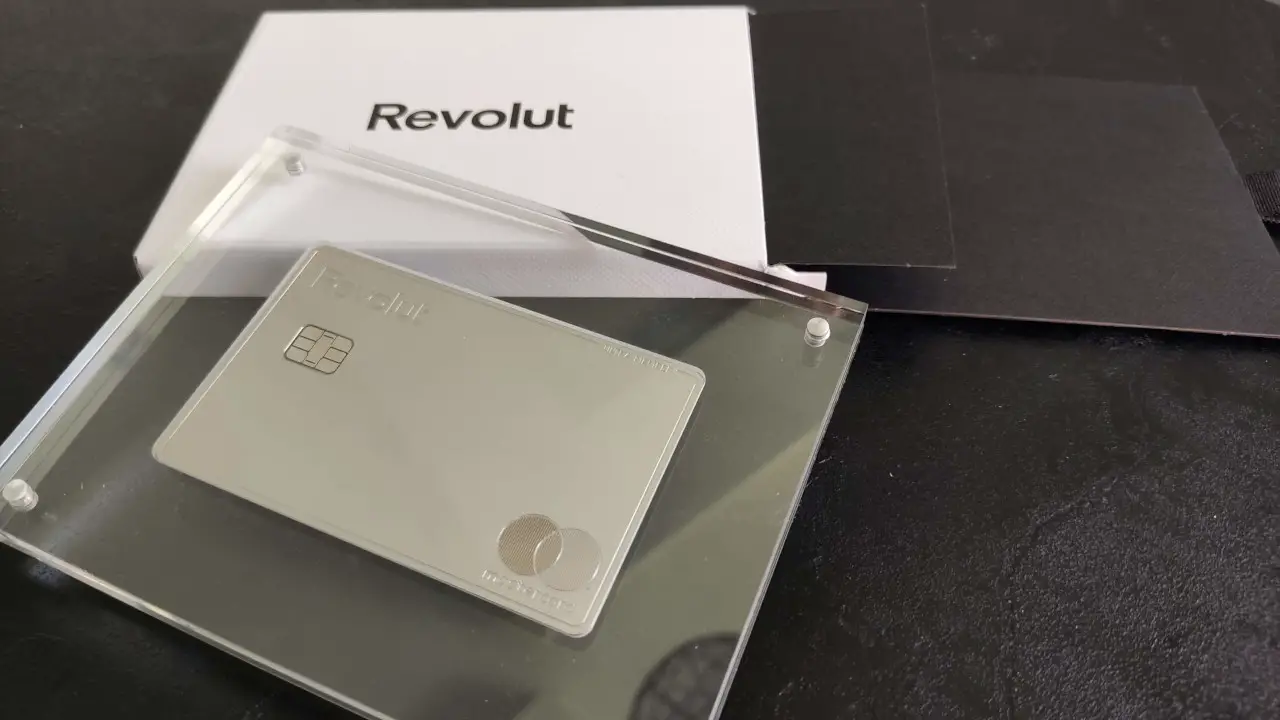

Pay Remote Freelancers With Revolut Ultra: Enjoy Many Benefits!

Revolut Ultra has emerged as a market leader, revolutionizing how remote contractors are paid. By combining the advantages of online banking and modern financial technology, Revolut Ultra offers freelancers a streamlined platform for managing their finances and receiving secure payments from clients around the world. With its user-friendly interface and innovative features, Revolut Ultra has become a popular and trusted option for remote freelancers seeking a hassle-free method of receiving payment.

Pay remote freelancers with Revolut Ultra benefits

Account setup

To begin using Revolut Ultra for international payments, you need to create a business account on Revolut. This involves providing the necessary details about your business and verifying your identity and business credentials.

Currency exchange

Once your account is set up, you can add funds in your desired currency to your Revolut Ultra account. Revolut provides competitive currency exchange rates and supports a wide range of currencies. You can convert your funds from your local currency to the freelancer's currency of choice within the Revolut app or web interface.

Adding freelancers

To pay a freelancer, you need to add them as a beneficiary within your Revolut Ultra account. You will need their bank details, such as account number, SWIFT/BIC code, and IBAN (if applicable). This information can be securely added through the Revolut app or web interface.

Payment initiation

After adding the freelancer as a beneficiary, you can initiate payments whenever needed. You can enter the payment amount, select the currency, and choose the freelancer's bank account. Revolut Ultra offers various payment methods, including bank transfers, SEPA transfers, and SWIFT transfers, depending on the freelancer's location and your requirements.

Real-time exchange rates

One of the significant advantages of using Revolut Ultra is the ability to access real-time exchange rates. This means you can make payments at the most favorable rates, saving you money on currency conversions. The rates are transparently displayed in the app or web interface, enabling you to make informed decisions while making international payments.

Multi-currency accounts

Revolut Ultra provides multi-currency accounts, allowing you to hold and manage funds in different currencies. This feature is particularly useful when dealing with freelancers who prefer to receive payments in their local currency. By keeping funds in the freelancer's currency, you can avoid repeated currency conversions and associated fees.

Instant notifications and tracking

Revolut Ultra sends instant notifications to both the sender and the recipient when a payment is initiated, received, or completed. This ensures transparency and allows freelancers to track the progress of their payments in real-time. It also provides an added layer of security by keeping all parties informed about transaction activities.

Expense management

Revolut Ultra offers robust expense management tools, allowing you to track and categorize your payments easily. You can generate reports, export data, and integrate with accounting software to streamline your financial management processes. This feature simplifies the task of managing freelancer payments, making it easier to reconcile transactions and maintain accurate records.

Enhanced security

Revolut Ultra prioritizes security and employs measures such as two-factor authentication, biometric login, and transaction notifications to protect your account. Additionally, Revolut uses advanced encryption technology to secure your financial information during transactions, ensuring that your payments to freelancers remain safe and secure.

Competitive fees

Revolut Ultra offers competitive fees for international payments compared to traditional banking methods. The fees are transparently displayed before confirming the payment, allowing you to evaluate the cost-effectiveness of each transaction. By leveraging Revolut's low fees, you can save on unnecessary expenses associated with traditional cross-border transfers.

Conclusion

Using Revolut Ultra's services to pay freelancers abroad or in different currencies is a simple and effective way for businesses to pay remote workers. With features like real-time exchange rates, multi-currency accounts, quick alerts, and tools for keeping track of expenses, Revolut Ultra makes it easier to pay people in other countries. Businesses can make sure that paying freelancers goes smoothly and costs as little as possible by taking advantage of low fees, safe transactions, and clear tracking. By using Revolut Ultra's ease of use and benefits, companies can improve their relationships with freelancers, improve their financial management, and reach more people around the world. Revolut Ultra makes it easy and safe for companies to work with freelancers around the world, whether they need to change currencies, make payments, or keep track of expenses.

Frequently Asked Questions

- What are the advantages of using Revolut Ultra for paying remote freelancers?

- Revolut Ultra offers several advantages for paying remote freelancers, including low transaction fees, real-time currency exchange rates, the ability to hold and exchange multiple currencies, and streamlined payment processes. These features make it a cost-effective and efficient solution for international payments.