Wise Debit Card Cashback: A Game-Changer for Budget-Conscious Consumers

Introduction to Debit Card Cashback

What is Debit Card Cashback?

Debit card cashback is a feature offered by some financial institutions that allows customers to earn a certain percentage of their purchase amount back as cash rewards. Unlike credit card cashback, which involves accumulating points or rewards that can be redeemed later, debit card cashback provides immediate cash savings. When making a purchase using a debit card, customers have the option to request additional cashback, typically up to a certain limit. This cash is then added to their total purchase amount and withdrawn from their bank account. It’s a convenient way for budget-conscious consumers to save money while making everyday purchases.

Benefits of Debit Card Cashback

There are several benefits to utilizing debit card cashback. Firstly, it allows consumers to stretch their budget further by earning cash rewards on their regular expenses. This can be particularly helpful for those on a tight budget or looking to save money for future goals. Additionally, unlike credit card cashback, there is no risk of incurring debt or interest charges with debit card cashback. It encourages responsible spending and financial management. Furthermore, the process of earning and redeeming cashback is straightforward and hassle-free. Consumers can easily access their cash rewards without the need for additional steps or complicated redemption processes. Overall, debit card cashback is a game-changer for budget-conscious consumers, providing immediate savings and promoting responsible financial habits.

Understanding Wise Debit Card Cashback

Introduction to Wise Debit Card

The Wise Debit Card is revolutionizing the way budget-conscious consumers manage their finances. This innovative card offers not only the convenience of a traditional debit card but also the added benefit of cashback rewards. With every eligible purchase made using the Wise Debit Card, users have the opportunity to earn a percentage of their spendings back in cash. This cashback can then be used towards future purchases or even deposited directly into their bank accounts.

How Wise Debit Card Cashback Works

The Wise Debit Card cashback program is straightforward and user-friendly. When using the card for purchases, users earn a percentage of their transaction amount back as cashback. The exact percentage may vary depending on the specific terms and conditions of the card issuer. Some cards may offer higher cashback percentages for certain types of purchases, such as groceries or gasoline.

To redeem the accumulated cashback, users typically have the option to either apply it towards future purchases or request a direct deposit into their bank accounts. This flexibility allows consumers to maximize the value of their cashback rewards based on their individual preferences and financial goals.

Maximizing Cashback Rewards

Strategies for Maximizing Wise Debit Card Cashback

When it comes to maximizing the benefits of your Wise debit card cashback, there are a few key strategies you can employ. First and foremost, make sure you understand the terms and conditions of the cashback program. Familiarize yourself with any spending thresholds or exclusions that may apply.

One effective strategy is to use your Wise debit card for everyday purchases and expenses. By using it for groceries, gas, and other regular expenses, you can accumulate cashback rewards quickly. Additionally, consider using your Wise debit card for larger purchases or bills, as this can help you earn even more cashback.

Another smart strategy is to take advantage of any special promotions or partnerships that Wise may offer. Keep an eye out for opportunities to earn bonus cashback or double rewards on specific purchases. Wise may collaborate with certain retailers or service providers to offer enhanced cashback rates, so be sure to take advantage of these offers when they arise.

Tips for Wise Debit Card Cashback Management

To effectively manage your Wise debit card cashback, it’s important to have a clear plan in place. Start by tracking your spending and cashback earnings regularly. This will help you stay aware of how much cashback you’ve accumulated and ensure you don’t miss out on any rewards.

Consider setting a specific savings goal for your cashback earnings. Whether it’s for a vacation, a special purchase, or an emergency fund, having a goal in mind can provide motivation and direction. By allocating your cashback towards your goal, you can see tangible progress and feel rewarded for your efforts.

It’s also wise to review your cashback redemption options. Wise may offer various ways to redeem your earnings, such as statement credits, gift cards, or depositing the cashback into a savings account. Evaluate which option aligns best with your financial goals and preferences.

Comparing Wise Debit Card Cashback to Other Rewards Programs

Debit Card Cashback vs. Credit Card Rewards

Debit card cashback and credit card rewards are both popular programs that offer benefits to consumers. However, they differ in several key aspects. Debit card cashback allows customers to earn a percentage of their purchases as cashback directly into their bank accounts. On the other hand, credit card rewards typically offer points or miles that can be redeemed for various rewards such as travel, merchandise, or statement credits.

One significant advantage of debit card cashback is that it encourages responsible spending and budgeting. Since the cashback is directly deposited into the customer’s account, it can be used to offset future expenses or put towards savings. In contrast, credit card rewards often tempt users to spend more in order to earn more rewards, potentially leading to debt if not managed carefully.

Wise Debit Card Cashback vs. Other Debit Card Cashback Programs

When comparing different debit card cashback programs, Wise Debit Card Cashback stands out for its unique features and benefits. Unlike traditional cashback programs that offer a fixed percentage on all purchases, Wise Debit Card Cashback provides higher cashback rates on specific categories such as groceries, gas, or dining. This targeted approach allows users to maximize their savings in areas where they spend the most.

Additionally, Wise Debit Card Cashback offers a user-friendly mobile app that provides real-time notifications and insights into spending habits. This helps users track their cashback earnings and make informed financial decisions. The app also includes budgeting tools, allowing customers to set spending limits and stay on top of their finances.

With its competitive cashback rates, category-specific rewards, and convenient app features, Wise Debit Card Cashback is an excellent choice for budget-conscious consumers looking to maximize their savings while managing their expenses.

Real-Life Examples of Wise Debit Card Cashback Success

Case Study 1: Saving on Everyday Expenses

Have you ever wished you could earn cashback on your everyday expenses? With the Wise debit card cashback feature, it’s now possible. Take the case of Lisa, a budget-conscious consumer who decided to give Wise a try. She was amazed by the savings she accumulated on her day-to-day purchases.

By using her Wise debit card for grocery shopping, dining out, and even filling up her car with fuel, Lisa was able to earn cashback on every transaction. This added up quickly, allowing her to save a significant amount of money each month. The Wise debit card cashback feature truly became a game-changer for Lisa’s budgeting goals.

Case Study 2: Travel Hacks with Wise Debit Card Cashback

Planning a trip can be exciting but also expensive. However, with the Wise debit card cashback feature, savvy travelers like Mark can unlock travel hacks that make their adventures more affordable. Mark decided to put his Wise debit card to the test during his recent vacation.

He was thrilled to discover that he could earn cashback on all his travel-related expenses, including flights, accommodations, and even local transportation. Mark also found that some travel partners offered exclusive discounts and deals when using the Wise debit card. This not only saved him money but also enhanced his overall travel experience.

Thanks to the Wise debit card cashback feature, Mark was able to stretch his travel budget further and explore more destinations than originally planned. It’s no wonder that the Wise debit card cashback has become a popular choice among travel enthusiasts looking to make the most out of their adventures.

Conclusion and Final Thoughts on Wise Debit Card Cashback

Recap of the Benefits of Wise Debit Card Cashback

Wise debit card cashback is revolutionizing the way budget-conscious consumers manage their expenses. By simply using their Wise debit card for everyday purchases, users can earn cashback on each transaction. This innovative feature provides an opportunity to save money and make the most out of their spending.

One of the key benefits of Wise debit card cashback is its flexibility. Unlike traditional cashback programs that limit rewards to specific categories or retailers, Wise offers cashback on all purchases, regardless of where they are made. This means that users can earn rewards on groceries, dining, online shopping, and more, allowing them to maximize their savings across a wide range of expenses.

Additionally, Wise debit card cashback is seamlessly integrated into the user experience. There are no complicated processes or hoops to jump through. The cashback is automatically credited to the user’s account, making it a hassle-free way to earn and accumulate savings over time.

Empowering Budget-Conscious Consumers

Wise debit card cashback empowers budget-conscious consumers to take control of their finances. By earning cashback on their everyday purchases, users can stretch their budgets further and achieve their financial goals more effectively.

The cashback feature acts as a financial incentive, encouraging users to make mindful spending choices. Knowing that a certain percentage of their purchase will be returned to them as cashback, consumers are motivated to prioritize their needs and make conscious decisions about their expenses. This promotes responsible spending habits and helps individuals stay within their budgets.

Moreover, Wise debit card cashback allows users to build up their savings effortlessly. Whether it’s for emergency funds, future investments, or a dream vacation, every cashback reward contributes to their financial well-being. This sense of progress and achievement encourages users to stay committed to their budgeting goals and reinforces their financial discipline.

In conclusion, Wise debit card cashback is a game-changer for budget-conscious consumers. By offering flexible rewards on all purchases and empowering users to take control of their finances, it opens up new possibilities for saving and achieving financial stability.

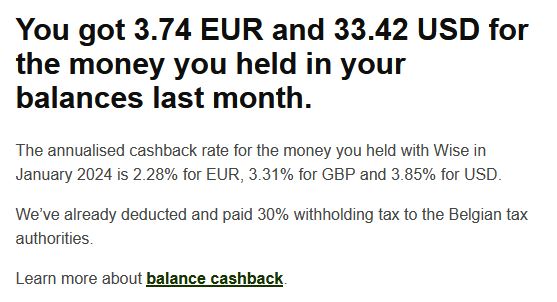

The annualised cashback rate for the money we held with Wise in February 2024 is 2.28% for EUR, 3.31% for GBP and 3.85% for USD.

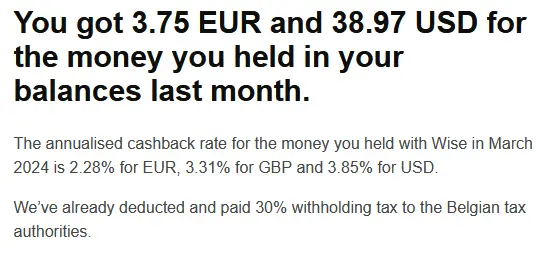

The annualised cashback rate for the money we held with Wise in March 2024 is 2.28% for EUR, 3.31% for GBP and 3.85% for USD.