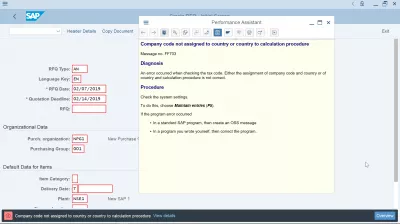

Company code assignment to country

Solve company code not assigned to country

When getting the issue company code not assigned to country or country to calculation procedure message number FF703, for example while creating a request for quotation RFQ, there are several steps to check in order to solve the issue and proceed with the document creation:

- create calculation procedure,

-

assign country to calculation procedure,

-

maintain tax code.

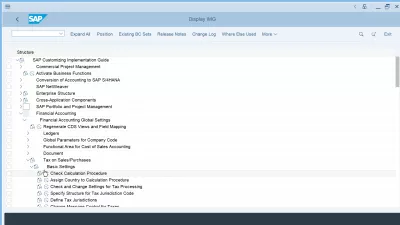

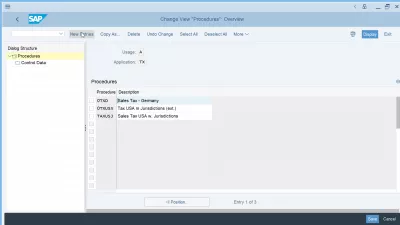

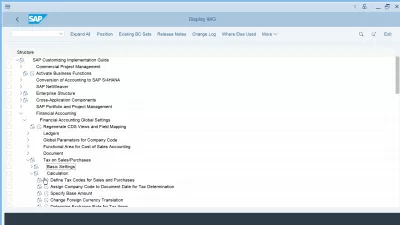

Create calculation procedure

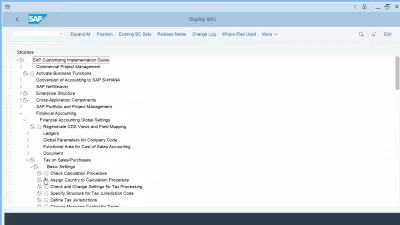

In SPRO customizing, go to Financial accounting > Financial accounting global settings > tax on sales / purchases > basic settings > check calculation procedure.

Select the activity change view procedures, and check if a calculation procedure already exists.

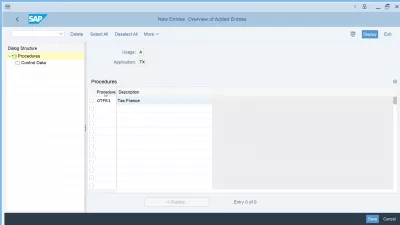

If not, it is necessary to create a new one, by selecting the new entries option.

Enter the procedure name and the procedure description, which should be enough to proceed with the calculation procedure creation.

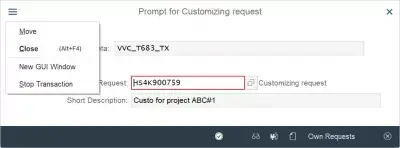

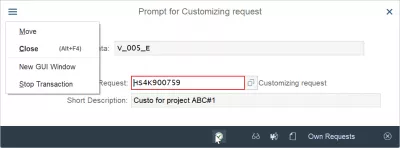

A customizing request will be necessary to save the changes and create the calculation procedure in the system.

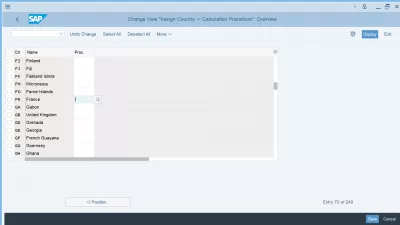

Assign country to calculation procedure

The next step is to assign the country to the newly created calculation procedure.

In SPRO customizing transaction, select financial accounting > financial accounting and global settings > tax on sales / purchases > basic settings > assign country to calculation procedure.

Now, find the country for which the assignment to the calculation procedure should be done. If the list of countries is too big, or you cannot find it, use the position option to jump directly to the required country position in the table.

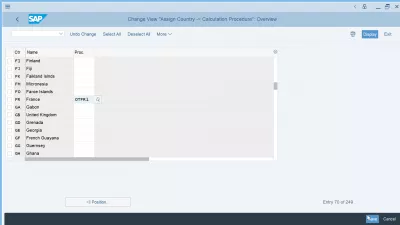

Once the country code line has been found, enter the corresponding procedure number, or press F4 to get a list of possible value of existing calculation procedures.

Once the calculation procedure has been selected and entered for the country, proceed with the save option. It is not necessary to enter a calculation procedure for all countries, but only for the countries used by a company.

A customizing request will be necessary for the operation to be completed and the information to be saved in the system.

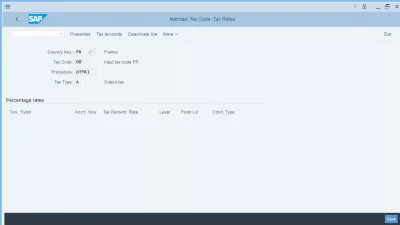

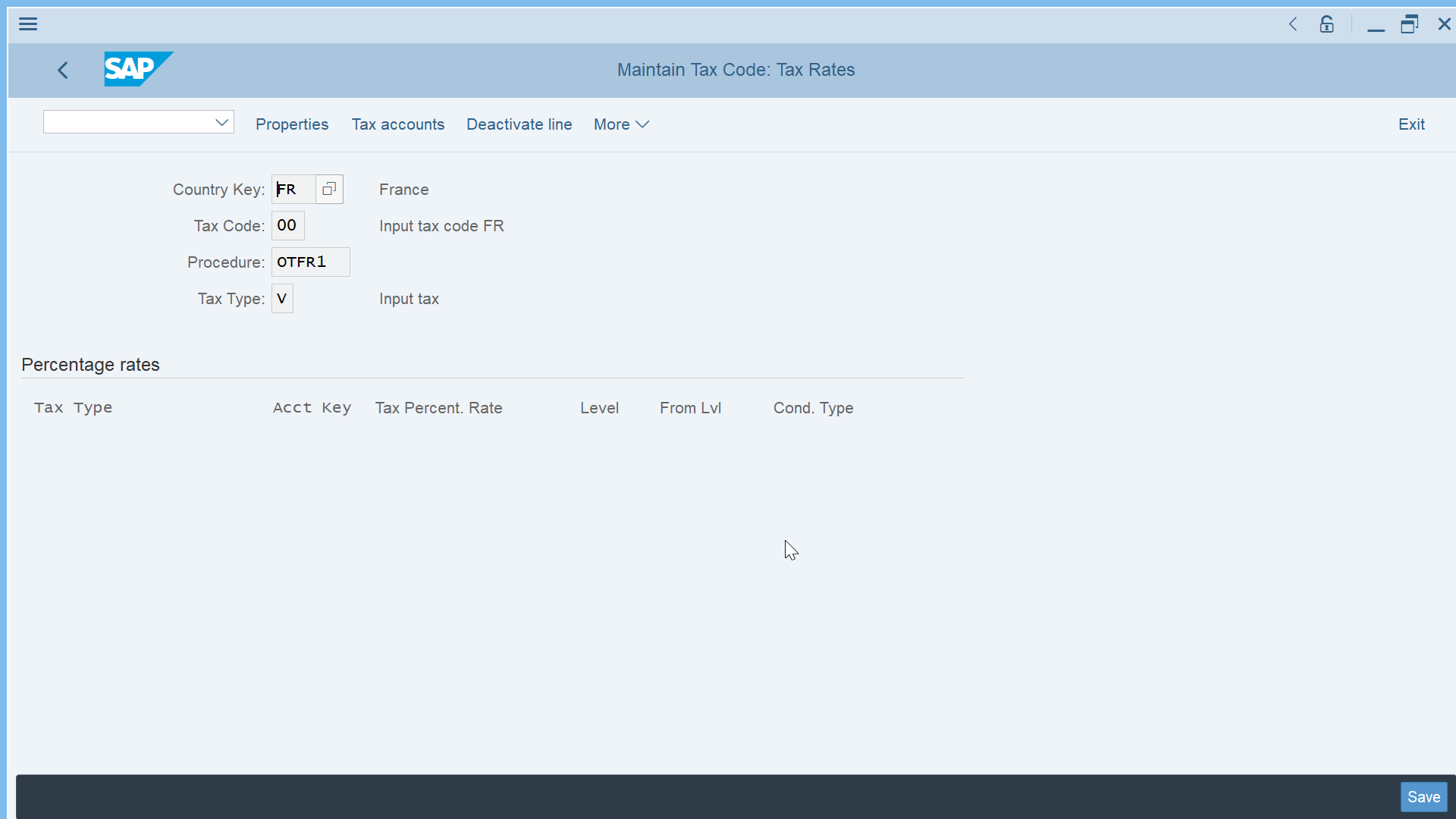

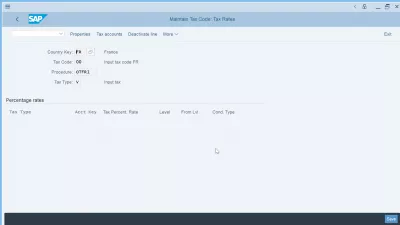

Maintain tax code

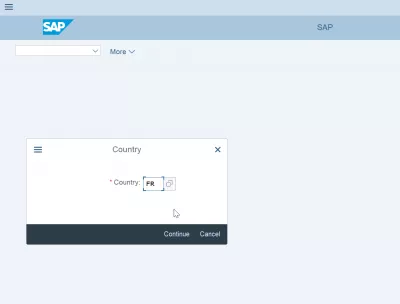

The next and last step is to maintain the tax code for the corresponding country in which the calculation procedure assignment has been performed.

In SPRO, go to financial accounting > financial accounting global settings > tax on sales / purchases > calculation > define tax codes for sales and purchases.

The transaction will directly show a prompt asking for country code, enter there the country code in which the tax code has to be defined.

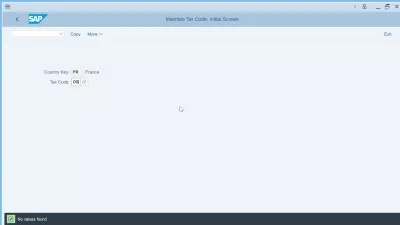

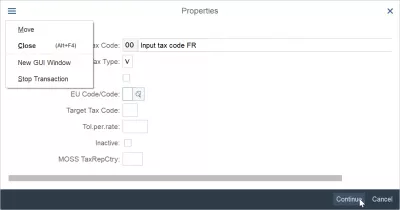

After that, simply enter the tax code that should be used for the country, such as 00 for example, but of course adapt it to local needs.

The properties of the tax code can be entered now, such as tax type, European Union code flag, target tax code, tolerance, inactivity flag, and more.

The tax code will be created and can be saved. Make sure that the correct tax type has been entered.

If necessary, do not hesitate to create a tax code for each tax type, for example one input tax and one output tax for the given tax code.